16 Ways to Stop Worrying and Start Living the Life You Love

If you’ve ever been in serious debt or are right now you know the feeling that your creditors own you lock, stock, and bank account. I’ve been there, I know. Debt steals your freedom one option at a time until you become its prisoner.

Debt keeps you chained to a job you hate. It keeps you stuck in the past, unable to move forward in life. And big debt causes terrible stress that makes it hard to breathe, keeps you awake, spoils relationships, and zaps the joy out of living.

It makes sense that if debt steals your options, then repaying debt creates financial freedom. But that’s not necessarily true.

If you spend just the amount you earn, you won’t be living beyond your means or creating new debt to bridge the shortfall, but you will be broke at the end of every month spinning your wheels, living from one paycheck to the next.

The first rule of sound money management is to live below your means—spend less than you earn. This means creating a margin between what you earn and what you spend. The secret to finding financial freedom—freedom from financial worry, fear and want—is the gap between the amount you earn and your spending.

The wider the gap, the more freedom you will enjoy. The money you don’t spend gives you the freedom to grow your dreams and prepare for the future.

Widen the gap

There are two ways to increase the space between what you earn and what you spend:

- spend less

- earn more

The harder you work at doing either—or both—the more successful you’ll be in finding financial freedom: freedom to fund your children’s educations, freedom to travel, to invest; freedom to relocate, to retire—freedom to live the life you love.

How to spend less

Sounds so easy, doesn’t it? Just spend less. If it were that easy, we wouldn’t be adding $15.2 billion in revolving consumer debt per month, as Americans did in Feb. 2019. We’ve become addicted to spending, so it takes a concerted effort to reverse that obsession.

Spending less takes work but is the best way to quickly change your financial situation. You’ve already earned the money and paid taxes on it, so there’s no waiting.

Get serious

Put your commitment to spending less in writing. Be specific about how much you intend to reduce your spending and how you plan to do this.

“Pre-spend” your income on paper before you ever spend it for real—curiously known as a budget. Set limits and boldly enforce them. Keep track in writing where all the money goes.

Cheat sheet

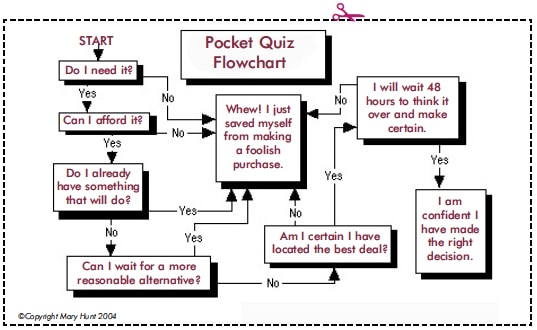

Write the following on a 3×5 card (or print my Flowchart below), which you can keep with you at all times and to which you will refer before spending more than $20 on anything:

- Do I need it?

- Do I have something already that will do just as well?

- Do I need it right now or can it wait?

- Have I found the best value?

Stop long enough to run whatever it is you’re about to buy through the filter of these questions. The minute you get a “No,” walk away.

Wait

Impose on yourself a specific period of time you must wait before making the purchase; the time you can think clearly. You would never believe how many times I’ve come to the point of purchase and then enforced my personal 24-hour rule. It says I have to go home and sleep on it. More times than not I just don’t go back, either because I changed my mind or, more likely, because I completely forgot. This works well for us impulsive types.

Ways to earn more

While earning more money is more complicated than cutting spending and takes more time and effort to produce results, this is the way to expand your gap more dramatically.

Increase hours

If available, pick up more hours on your current job.

Improve a skill

There are myriad ways a skilled artisan or musician can create an income stream. If that’s you, hone those skills

Moonlight

We’re not talking the rest of your life—only a season from time to time. It won’t kill you to work nights and weekends at a second job.

Freelance

Are you a graphic designer, website developer, marketing expert, copy editor or creative writer? Freelance your services to small businesses. Take a look at Elance.com or Fivrr.com where providers can bid on small jobs posted by businesses and others.

Rent out

Perhaps you have a garage you’re not using. Rent it out for vehicle storage. Rent a spare room to a college student.

Get educated

Finish a degree or take specific classes if it qualifies you for a promotion at your present place of employment. Figure out what you need and then do it.

Network

Get the word out in your social and business circles that you’re ready, willing and able to offer your services.

Embrace frugality

Frugality means maximizing every dollar so you stop wasting money and fund your gap. Set your own standards and you won’t have to worry about doing anything that makes you squeamish.

Plug the leaks

Start paying attention to where the money is leaking out of your life. Look at everything, from using excessive amounts of electricity and water to paying too much for insurance.

Cook at home

Take a look at how much you’re spending on food outside the home—diners, coffee shops, restaurants, drive-thrus, and other fast-food joints. Yikes. Are you starting to see why your gap is so thin? Learn to cook at home and you’ll turn that $40 tab to feed a family of four into a tasty $5 meal at home.

Make a game of it

If you currently shop for groceries once a week, see if you can beat the frequency by going every ten days. Then stretch it to twelve—even two weeks. Make it a game to see how long you can make a tank of gas last. Now make it last even longer.

Get help

Resources galore are waiting for you in the books I’ve written—I would be honored for you to read them—but also right here in this blog’s Archive. If you are not signed up to get my daily email, subscribe here (it’s free!). There’s nothing like a daily frugal fix to keep you on track.

HI i have written before regarding my financial delemma but hadn’t heard anything. I am 77 and over the years have used my credit cards to help family. my credit cards are high and with the rates going up I am trying to get some help. banks won’t help, and i’m not sure about debt consolidation, not relief, my score is 651. i stay awake at nites trying to think of ways, sell furniture etc. where else can i go. my brother is in nursing home and i have his dog whicch is another bill. I need to get help with the credit card amt so i can have money freed up to get a facial and do something for me. thank you

Go to NFCC.org immediately. Or if you prefer, call NFCC at 800-388-2227. You have a difficult situation, Teresa and one created out of your desire to help others before you were financially secure. Going into debt to help relatives because you do not have the money in hand to do that may see like a kind and caring thing to do, but it’s like trying to rescue a drowning person when you don’t know how to swim. Both of you will likely drown. That may sound harsh, but it’s time to face the truth. Without dobut, you will have to make some difficult decisions going forward. I hope you will make that call as soon as possible. These are good people at NFCC and they can help. You can trust them. I wish you well!

Wood home furniture has something quite natural about it. There is this feeling of warmth,

of attribute and also of style that may be be discovered in wood furnishings.

Hardwood is actually born coming from the earth.

It seems like I chime in every time Mary posts something like this to second her advice. I learned to live below my means (partly accident and partly by design) when I was just starting out. I perfected it when I was poor and I continue it now that I’m doing better and earning more than ever before. I’ve followed this path and although I’m not wealthy, I have Financial freedom and peace of mind. It really is as simple as live below your means. One big tip I’ll add to Mary’s list is to consider purchases in terms of how many hours you’ll work to pay for them. Two hours (or more) of work for a meal out (and not even a really nice one) makes the idea much less appealing. You’ll find your impulse buys pretty much disappear and you won’t miss them.