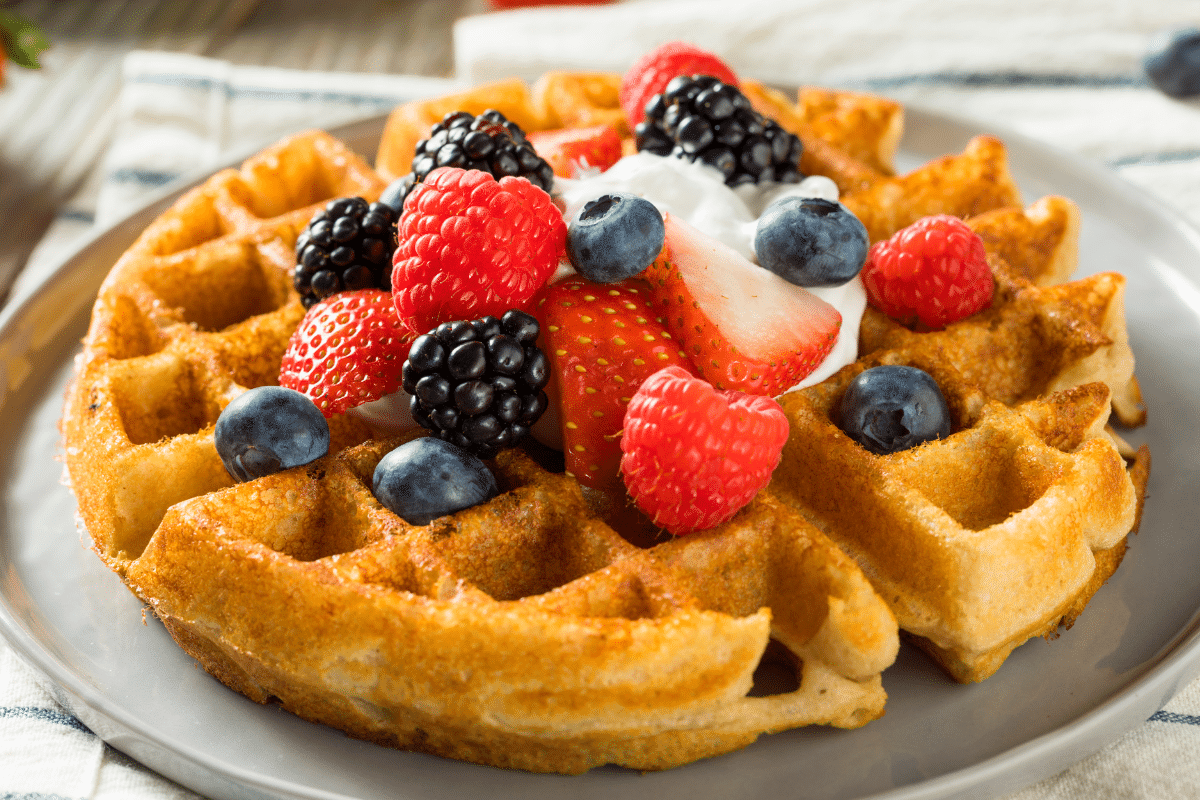

Beat the Heat: Budget-Friendly Frozen Desserts for Summer

From refreshing slushies to creamy milkshakes, beat the summer heat affordably with these easy frozen dessert recipes.

Welcome to Everyday Cheapskate!

Sign up HERE to get Mary’s Everyday Cheapskate™ daily newsletter. It’s short, usually sweet, and always a lot of fun (free eBook!)

https://www.everydaycheapskate.com/wp-content/uploads/20240403-front-view-of-dishes-and-utensils-in-a-dishwasher-scaled-e1714274945908.jpeg

800

1200

Mary Hunt

https://www.everydaycheapskate.com/wp-content/uploads/EC-Logo-by-Mary-Hunt-Tagline-Trimmed.png

Mary Hunt2024-05-12 10:45:332024-05-12 10:41:3414 Things That Should Never Go in the Dishwasher

https://www.everydaycheapskate.com/wp-content/uploads/20240403-front-view-of-dishes-and-utensils-in-a-dishwasher-scaled-e1714274945908.jpeg

800

1200

Mary Hunt

https://www.everydaycheapskate.com/wp-content/uploads/EC-Logo-by-Mary-Hunt-Tagline-Trimmed.png

Mary Hunt2024-05-12 10:45:332024-05-12 10:41:3414 Things That Should Never Go in the Dishwasher https://www.everydaycheapskate.com/wp-content/uploads/20240511-cozy-midcentury-modern-home-office-on-a-budget.png

800

1200

Mary Hunt

https://www.everydaycheapskate.com/wp-content/uploads/EC-Logo-by-Mary-Hunt-Tagline-Trimmed.png

Mary Hunt2024-05-10 23:40:532024-05-10 23:38:08How to Create a Home Office on a Budget: Creative Tips Practical Ideas

https://www.everydaycheapskate.com/wp-content/uploads/20240511-cozy-midcentury-modern-home-office-on-a-budget.png

800

1200

Mary Hunt

https://www.everydaycheapskate.com/wp-content/uploads/EC-Logo-by-Mary-Hunt-Tagline-Trimmed.png

Mary Hunt2024-05-10 23:40:532024-05-10 23:38:08How to Create a Home Office on a Budget: Creative Tips Practical Ideas