How to Store Important Documents and How Long To Keep Them

If the paper monster has you buried under an avalanche of receipts, bank statements, ATM slips, investment records, paycheck stubs, and bills—the good news is you can probably throw most of it away without worry when you have a simple record keeping routine.

But before you fire up the shredder, you need to know what to keep and for how long.

Toss all you can

Monthly

Once you have recorded the amounts and reconciled your bank and credit card statements, you can shred ATM receipts, bank deposit slips, credit card receipts, and sales receipts at the end of each month.

Exception: Keep receipts for purchases that may be tax-deductible, those that involve a warranty, and any item whose replacement cost exceeds the deductible on your homeowners’ or renters’ insurance.

Yearly

Once you receive and reconcile your W-2 against your final pay stub you can toss your paycheck stubs for the year, along with monthly credit card and mortgage statements, phone and utility bills, and quarterly and monthly investment reports.

The same goes for other statements that detail the entire year’s activity on the final end-of-the-year statement.

Keep what you must

One year

Keep pay stubs for at least one year so you reconcile them against both your W-2 Wage and Tax Statement (this is the form from your employer that shows how your annual earnings were allocated that you attach to your tax return) and the Social Security Earnings Statement you receive once each year in the mail (you can request a copy any time from www.ssa.gov).

If your records do not match the entries on these forms you’ll be happy to have your pay stubs to prove your earnings and withholding.

Three to seven years

Hang onto the following for at least three years: Year-end statements for credit card accounts, mortgage statements, investments, W-2s and 1099s that recap the year’s activities, canceled checks and receipts for deductible expenses, retirement account contributions, charitable donations, child-care bills, mortgage interest and all other items that support your income tax filings.

The IRS has three years to examine your tax return for errors and up to seven years if there’s a reason to suspect that you underreported your gross income.

Until all possible audit windows close, you should retain all documents that support and pertain to your IRS filings.

Active, Indefinite

As for receipts and records of bills paid, keep them as long as the situation is active.

Example: A paid water bill is no longer active once you receive the next statement that shows its payment was received and credited. But the receipt for your new water heater is. Attach it to the owner’s manual and warranty.

You can confidently destroy statements for closed accounts, expired warranties, canceled checks for minor items that are not proof of purchases or income tax-related, and instructions for appliances or equipment that you have sold or discarded,

Keep tax returns for the long haul and receipts for major purchases and home improvements as long as you own them.

In the event of an insurance claim, you may need to prove the purchase or your heirs will need to know how much you paid to determine the profit for tax purposes.

Forever

Birth records, military records, marriage and divorce records, death records, education and employment records, medical records, lawsuits, and family history documentation should be kept forever.

- MORE: Talk About Budgets?!

Pick a spot

If you don’t have a designated place for important paperwork, it’s going to end up in piles all over the house.

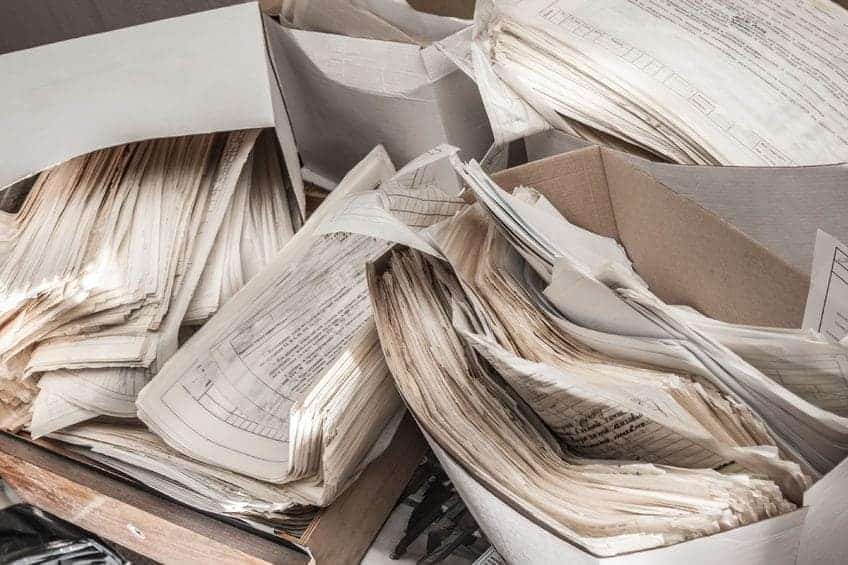

The secret to taming the paper monster is to designate one room, corner, drawer, cabinet or closet where you can store all of your bills, current records, and paperwork. You’ll need a trash can, file folders, some kind of box or container to hold them and a place close by to write.

Keep all of your important papers in this one place and if you will be keeping it for more than one month, create a file folder. One folder might be labeled “Tax deductible,” another “Insurance,” and so on.

Stick with it

Get into a routine of tossing what you can, then file the rest. Keep your system simple and you’ll be more likely to stick with it.

You don’t need to spend a lot of money to get organized. Four boxes with lids plus a good set of markers make a dandy system. Label the boxes:

- Three Years

- Seven Years

- Active/Indefinite

- Forever

You’ll be amazed at the difference a little organization will make in your life. You’ll be less likely to misplace bills, miss payment deadlines, or forget to take valuable tax deductions. But the big payoff will come in peace of mind.

Best Inexpensive Shredder

This budget-friendly, basic cross-cut paper shredder is excellent for home use. No need to remove staples, and it shreds credit cards, too.

Everyday Cheapskate participates in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for us to earn from qualifying purchases, at no cost to you.

More from Everyday Cheapskate

Please keep your comments positive, encouraging, helpful, brief,

and on-topic in keeping with EC Commenting Guidelines

Last update on 2024-05-10 / Affiliate links / Images from Amazon Product Advertising API

Is it completely safe to give your toss papers to a company that shreds everything in a big truck?

I can’t guarantee “completely safe” (is anything?), but it’s a fairly sure bet that if they take your papers and then don’t shred them but sell them to the dark web or some other nefarious opportunity, they won’t be in business very long. Before you pay for such a service, check it out. Look for reviews, see what guarantees the service offers. Most of them shred on the spot so stand out there and watch them load in your documents and papers in the onboard shredder

I have been POA and Trustee for several family members. This has involved selling properties and managing assets. What do I need to keep for those who are deceased and for how long do I need to keep these items? Help! I’m drowning in papers!

I’m not qualified to tell you which items, if any, you’re safe to toss. But I can suggest a better way to keep them under control: Scan them to an external hard drive or flash drive—one for each of the family members. Once you have electronic copies, you should be able to safely destroy the paper. Hope that helps!

Great advice, as usual. I would also recommend a fireproof box for those “keep forever” documents. A small portable one that can be grabbed in the event of an emergency is perfect.

I’m more confused than ever. Can you break down this info into easy to follow steps? Too much information here……..unlike you, dear Mary. — ck

It bothers me that my bank does not rerurn canceled checks. What should I do?

That’s a common situation with most banks these days. But you do have electronic access, I would assume. You can make it a habit to print out a copy of the checks for tax-deductible expenses and other similar.

Mary, this is a great article about how to store documents and how long to store them…..do you have them in an easily printable form that I could keep in my notebook??

Thanks for all your great information!!!

Scroll to the end of the post before the comments … there is a PRINT button there.

Hi Mary,

I’m a bit confused about tax forms…i have over 20 years’ worth in my files. Is it safe to destroy those over 7 years old? I notice you said for “the long haul” in one section, I just want to make sure!

Thanks so much for this information!

That’s a question the answer to which not even the experts agree. At the very least keep the actual 1040 form for each year. And please check with your own tax preparer to advise specific to your own situation.