How to Be a Good House Guest Worthy of a Repeat Invitation in the Future

From invitation etiquette to respecting your host's space, here are the unwritten rules of being a house guest worthy of a repeat invitation.

Welcome to Everyday Cheapskate!

Sign up HERE to get Mary’s Everyday Cheapskate™ daily newsletter. It’s short, usually sweet, and always a lot of fun (free eBook!)

https://www.everydaycheapskate.com/wp-content/uploads/20240419-DIY-dusting-spray-womans-hand-wiping-dusty-wood-surface-with-yellow-towel.png

800

1200

Mary Hunt

https://www.everydaycheapskate.com/wp-content/uploads/EC-Logo-by-Mary-Hunt-Tagline-Trimmed.png

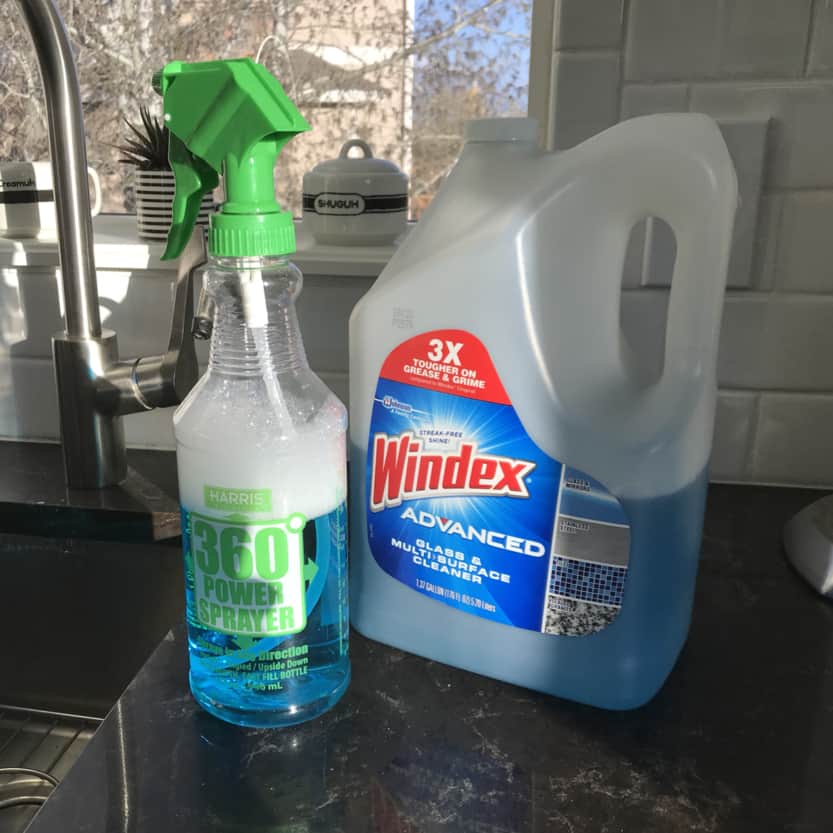

Mary Hunt2024-04-19 00:48:462021-04-23 12:16:59How to DIY Highly Effective Dusting Spray: Safe on Fine Wood Furniture

https://www.everydaycheapskate.com/wp-content/uploads/20240419-DIY-dusting-spray-womans-hand-wiping-dusty-wood-surface-with-yellow-towel.png

800

1200

Mary Hunt

https://www.everydaycheapskate.com/wp-content/uploads/EC-Logo-by-Mary-Hunt-Tagline-Trimmed.png

Mary Hunt2024-04-19 00:48:462021-04-23 12:16:59How to DIY Highly Effective Dusting Spray: Safe on Fine Wood Furniture https://www.everydaycheapskate.com/wp-content/uploads/20240418-mothers-day-brunch-overhead-view-scones-bread-fruit-coffee.png

800

1200

Mary Hunt

https://www.everydaycheapskate.com/wp-content/uploads/EC-Logo-by-Mary-Hunt-Tagline-Trimmed.png

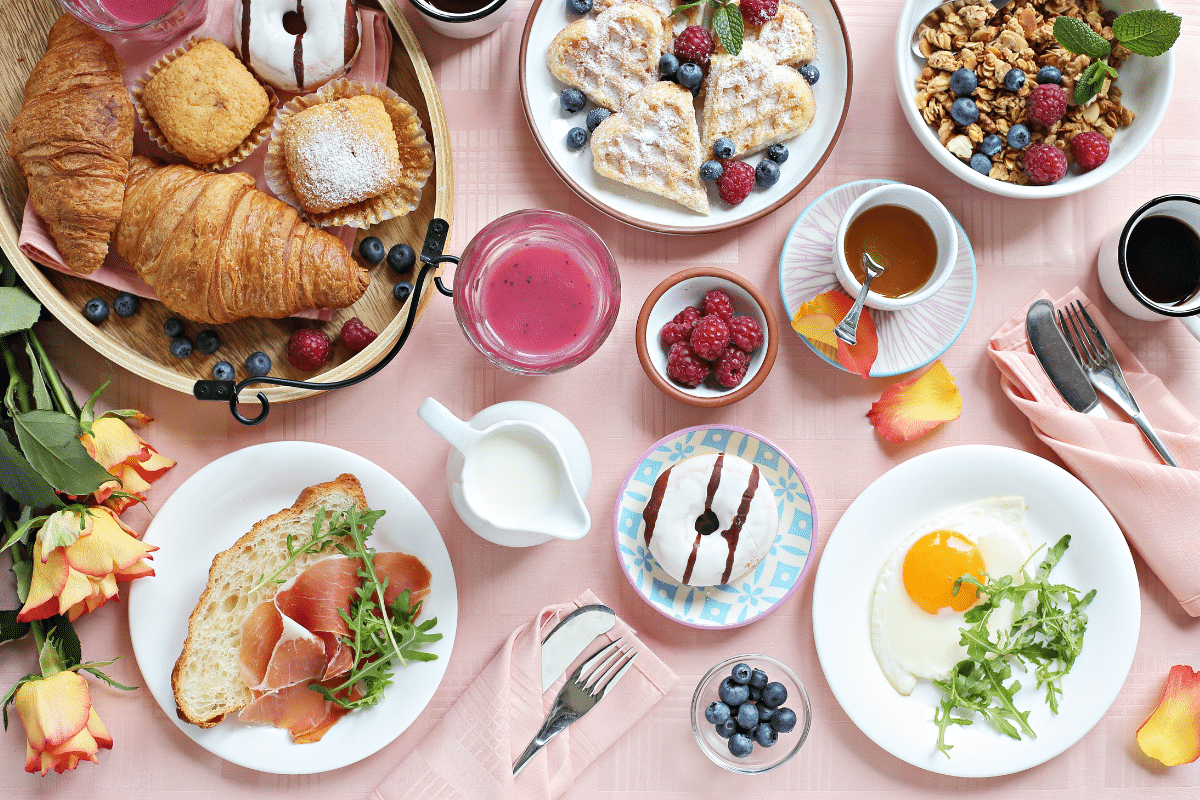

Mary Hunt2024-04-18 00:39:222024-04-18 13:57:47How to Plan, Prepare, and Host the Perfect Mother’s Day Brunch at Home

https://www.everydaycheapskate.com/wp-content/uploads/20240418-mothers-day-brunch-overhead-view-scones-bread-fruit-coffee.png

800

1200

Mary Hunt

https://www.everydaycheapskate.com/wp-content/uploads/EC-Logo-by-Mary-Hunt-Tagline-Trimmed.png

Mary Hunt2024-04-18 00:39:222024-04-18 13:57:47How to Plan, Prepare, and Host the Perfect Mother’s Day Brunch at Home