How to Slash a Family’s Food Budget without Causing a Revolt

The year was 1992. We’d just come through 10 long years of repaying more than $100,000 of credit card debt I’d stupidly amassed. I’d come this close to losing my marriage, my family, our home and basically blowing up my life. Debt has a way of doing that.

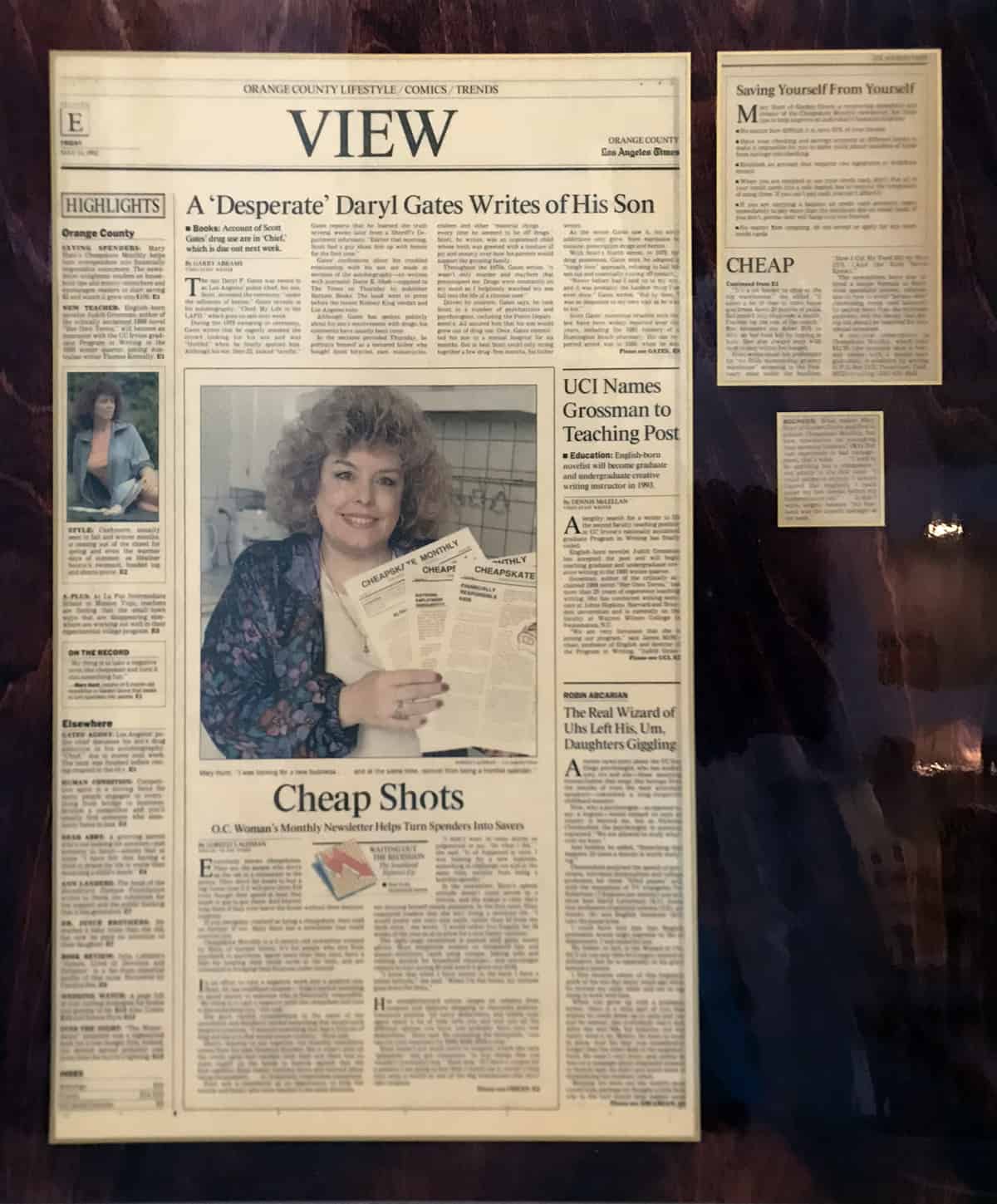

After ten years, we’d brought that awful balance down to just $12,000. I could not wait to get it paid to $0. I got this wild idea to write a newsletter about our journey (back then, no Internet, no email, only an IBM Selectric typewriter … yep, that long ago!) hoping that enough people might pay $12 a year to subscribe. They did, oh boy did they. And Cheapskate Monthly was born—during a recession.

Long story short, The Los Angeles Times called, Oprah called, Dr. James Dobson called and the rest is history. The world has changed incalculably in those 30 years. There have been economic highs and lows. We’ve endured the recession of 1992, the horror of 9/11; the Great Recession of 2008 and Pandemic of 2020. We’ve come through and each time, been better for what we’ve learned.

What you are about to read is from Cheapskate Monthly, Issue No. 2, February 1992, which I found in a neatly preserved file my dear mother-in-law left with my name on it. She’d typed out the contents of each of those early newsletters, together with a note that I might like them one day in the future.

Here it is, word-for-word followed by an Epilogue and little surprise from 1992 …

I Slashed My Family’s Food Bill

It’s true! I’m living proof that it really can be done—consistently, month after month! I know that no one person’s situation can be duplicated in another’s life. Hopefully, my experiences in getting control of our food spending might inspire you to look at your own situation and see if there might be some area of reform.

Since I cannot document exactly how much we spent on food in our pre-cheap days I cannot guarantee exactly how much we have cut back. I do know that 25% is very conservative and I have a feeling it is more like 40%.

My family is made up of two adults, two teenage boys and one cat. You might as well meet them now—my husband Harold (of Canadian extraction), sons Matt and Jim (their middle names to avoid potential embarrassment). Both of us work full time outside the home and both boys attend school. We live in a large metropolitan area of Los Angeles.

When faced with financial disaster, I did what any spoiled spendthrift might do—I cried, whined, and worried myself sick. Somehow in my vast life’s experiences (??!) I missed that part about budgeting, saving, and being financially responsible. By and by, I did come to my senses and it became clear that if we were to survive, we were going to have to learn to live on a whole lot less money. Where to start?

The most obvious for us was in the food department. We spent money every day on food—either at the grocery store or at restaurants/fast food places. Our food purchases had no pre-planning, rhyme or reason. We spent cash, we used credit cards indiscriminately, and I wrote checks—some of them bounced and some of them didn’t. We ate out very often and very regularly because . . .

We are busy!

I work full-time you know (OUTSIDE THE HOME!!)

I am so busy.

I don’t have time to pack lunches.

After a long day at work the last thing I want to do is come home and COOK!!

Let’s let someone else cook and clean up!

I forgot to take something out of the freezer.

I’m just not domestic.

Who me? Cook? You must be joking!

I’m just so busy!

I realize now that these were just excuses, but at the time I really believed every one!

Steps I took to change

1. Determine current food spending

It’s not easy!! Start writing down everything you spend on food for at least one month. I mean everything—from the donut and coffee on the way to work to the fast-food stops with the kids, lunch money and major shopping jaunts. This is what you are spending on food, and plan on a big shock. Your awareness of this total number is going to be the first and biggest step you will take to get into food control.

2. Shop with cash

When I go into the store without a checkbook or credit card, I am keenly aware of how much I have, and I shop very carefully to avoid embarrassment at the checkout. If I have a checkbook I go into some wild trance which “assures” me unlimited funds. It’s crazy I know, but I can just go nuts. So, for me, it’s CASH ONLY. It is a great discipline and requires that I plan ahead.

3. Shop once a month

Hold on—let me explain. I call this monthly trip my “major shopping.” I make this pilgrimage to a no-frills, membership grocery warehouse. I can fit an entire month’s shopping (about 90% of what we need for the month) in my mini-van. I think I shop pretty wisely and cautiously and this fiasco takes at least half a day. But then I’m done for the month except for picking up produce and milk.

4. Avoid leftovers

They’re hard to get rid of—so try and prepare only what your family will eat at any one given meal. Many times I will make two casseroles and freeze one for later. That doesn’t qualify as a leftover! I call leftovers those small unattractive portions that are in odd-shaped and mis-labeled containers, placed in the refrigerator until they resemble biology specimens.

5. Eliminate choices at meals

Stick to a healthy, simple menu. Picky eaters will soon “come around” if they know their choices from now on are two: Take it or leave it!

6. Change eating habits

There are many benefits to becoming semi-vegetarian. I think everyone agrees that the typical American eats far too much meat.

7. Buy in bulk

I had to reorganize my kitchen and pantry as well as clearing a place in the garage for dry food storage.

8. Become a shelf-life expert

It takes a little time, but by re-packaging bulk foods at home, you can save big bucks. I invested in a home vacuum sealing machine. Vacuum sealed cheese, meat, crackers, chips, cereal, etc. last for (it seems like) forever. I vacuum seal most everything before freezing to eliminate freezer burn. I have used meat for up to one year after sealing and freezing.

9. Avoid pre-prepared and processed food.

I had to start cooking and baking — tasks I thought I would not have time for. I started a weekly routine of baking cookies, bread, desserts, casseroles, etc. We couldn’t completely change our prior eating and shopping habits overnight. I started with one or two pledges and went from there. Before long I was actually cooking and baking from scratch and introducing my family to a whole new world of interesting and economical foods.

10. Bring some excitement to your eating area

In our “pre” days we very rarely ate together at a table. Being busy and very unprepared, it was usually hamburgers in front of the TV. I decided if I was going to expect my family to be content with less “exotic” (??) menus, I was going to have to create a very attractive atmosphere to transform macaroni and cheese into a gourmet affair.

I rearranged the family room and kitchen by moving the table and chairs from a dark corner of the kitchen into a new eating area at the end of the family room right by the fireplace and next to a large window.

We installed a ceiling fan/light over the table and voila!—our own restaurant! Since that time, we’ve sat down together for many, many meals. Even the simplest meal seems to taste better with such a cozy well-lit area.

We began to do family things around that table—games, homework, crafts, etc. Creating this new setting cost us nothing. We just used what we had and did a lot of rearranging!

11. Approach the supermarket with tremendous caution

Start thinking of that place as the wicked witches’ gingerbread cottage. It is beautiful, it smells scrumptious, it is very inviting—and it’s going to get you if you’re not careful. From the moment you drive up that store owner is doing everything possible to nurture your compulsive buying habits.

12. Reserve eating out for special occasions

There is no way you can eat out more cheaply than at home. Reserve that extra expenditure for truly important occasions.

13. Load up on “loss leader” sale items

These very low priced items are the bait to get you in the store. If you buy nothing but these items, the store is not making much, but you are saving a bundle. Buy in quantities great enough to last until the next sale.

In addition to saving a lot of money by changing our food style, we eat much more healthily, we are consuming far fewer preservatives, home-cooked food tastes a lot better and we have much better family communication. We actually sit down and eat together. Amazingly I am really enjoying the domestication of cooking and baking, and somehow I am no busier now than I ever was!

Epilogue

I did raise that $12,000. We paid that debt in full and in short order. My plan was to quit the newsletter and get on with my life—a kind of fresh start. But I couldn’t. It became my life and continues (with lots of changes and iterations) to this day. My marriage survived, our sons are grown with families of their own, the cat now a distant memory. What a journey—and it’s not over yet!

In fact, right now it feels like we’re heading into a new phase—another mountain to climb with challenges and opportunities yet unknown.

123rf.com

123rf.com

Mary, look at how God has used your crisis for good and so many lives. Romans 8:28

Thank you, Mary, for all the advice over the years. It’s funny that I thought some of your advice for credit cards was so ridiculously unattainable…only to go back to it, over and over, until now to be CC debt free. I can’t wait to start my DIY vanilla for Christmas gifts!

My awakening started in the mid seventies Mt wife and I had good jobs so we thought nothing of flying someplace for the weekend. Problem was, I was an economics major and a credit manager and our social life didn’t agree with my principles. The light finally dawned when, after two years of marriage, we couldn’t pay off our credit cards in a month… or three. It was an instant turnaround – buy nothing we couldn’t pay off in thirty days, excluding car and house, of course. It took fifteen years to realize a car should be included my thrift rule, and ten more years to pay off the mortgage. Now, our only “debts” are taxes so moving to a smaller house is in the offing, but to my amazement, I’d thought California’s Prop 13 would finally spur the nation to realize that property taxes are the most oppressive, arbitrary and outrageous tax we have, but people still pay without a peep. I mean, everyone in America rents from the government lest they be “evicted.”

I sure am with you regarding property taxes. Here in Texas, they are eating us alive, especially we seniors. Fortunately, they are frozen in most cases when the homeowner reaches 65; nevertheless, it will be a burden for this single divorced older mom who is the caregiver of an adult autistic son.

I meant to say, “. . . in most counties . . .”

I too was one of your snail-mail subscribers in the mid-late 90’s. I beleived debt was something all Americans would always have, never realizing a day would come that my and my future husband would become debt-free beyond our mortgage. Thanks again for your tips and help.

Loved the flash back (and the hair-do) lol, had one just like it!

I remember looking forward to getting your newsletters in the mail and devouring them. Although we were not in debt, your resources enhance our frugal lifestyle and enabled us to prosper many years now by helping us make wise decisions.

Ways to save was like a treasure hunt to me and your newsletters and website were the clues in my adventure!

Many thanks and may God continue to bless you. I am grateful to Dr. J. Dobson too 🙂

Hi Mary

I have been with you from almost the very beginning. Sometimes my subscription stopped and I’d suddenly wonder why I was getting off track. Then I’d realize…” I let my subscription expire”! So back on I have been. You have helped in so many ways. First with mental healthy…by making better choices…which includes second, by becoming debt free. You are better than a sweet lifesaver because you last forever. Thank you✨

Mary, You don’t know it, but you got my family through the 2008 mortgage interest crisis and we have told our money what to do ever since. I can’t tell you how many times I have said to myself, “If only I had had these tools when starting out life on my own.” So my husband and I have the peace of mind of having I taught our kids your method and know that they have been given the tools. We definitely practice what we preach. Now, recent college grads, it’s up to them. THANK YOU!

ps. I believe I’m one of your charter members too!!!

Mary, thank you. I found us in a tough situation about 20 years ago. I played the no interest C C game and transferring to rid debt. Wonderful to be debt free for years now. Eating at home has been our save. Likely I spend too much on groceries, but we do eat well, healthy, and at home. It seems we were frequently disappointed with food at restaurants anyway. Your newsletter has saved us $ in so many ways. Thank you.

Linda

I thought if sending this column to my daughter, but here is her situation She and her partner moved into an apartment on January 1st. Fast forward to mid-March and all has changed . She is a contract worker in theatre and all her contracts have dried up. Her partner is still working, but who knows for how long. Living in an apartment they would be unable to use most of the strategies you propose as there is no room to store bulk purchases. Do you have some strategies for saving food costs for people in their situation?

One tip I have (I live in a very small house) is to use “non-kitchen” storage for canned goods, paper products, etc. if possible. Do things like put a tablecloth on an end table and hide the extra toilet paper. If they have a car, have a box in the trunk for things not affected by heat/cold (or again, tp and paper towels!). Store extra canned goods on the shelf in the bedroom closet, or in a shallow box/container under the bed. Having said that, I don’t buy “huge” amounts of most things, but I do try to stay stocked up.

Who has extra TP?haha

Seriously, I first heard you on the radio in my car in the early 90’s. I had just become a divorcee with all the credit card debt my husband (mostly) had racked up…he had to pay off his big student loans, so I got all 20 of our credit card bills. You inspired me to pay it all off in a little over a year. I still won’t have a credit card. I do use a debit card when paying cash is not an option.

I subscribed to Cheapskate Monthly and sent it as gifts to most of my six grown kids.

What a blessing to be able to live and give and not worry about bill collectors! Thank you for your inspiration, Mary! Frugality is so much fun!

Buy with cash or don’t buy at all. If they will stick to that one thing and I mean without any deviation, it will change everything. All options to spend money they don’t have, get deeper into debt, are gone. It’s impossible to overspend cash!

Your story is inspirational. I’m happy you kept writing the newsletter. I may have been one of your pioneer clients. It was so long ago. . . We came a long way. And I still enjoy your “newsletters.”

We go back a long time, Gina! How fun to know you’ve been on this journey with me.