Broke and In Debt? How to Give Yourself an Extreme Money Makeover

In debt? Overdrawn? Foreclosure notice? No matter how extreme your situation, here are steps to start your own money makeover.

Welcome to Everyday Cheapskate!

Sign up HERE to get Mary’s Everyday Cheapskate™ daily newsletter. It’s short, usually sweet, and always a lot of fun (free eBook!)

https://www.everydaycheapskate.com/wp-content/uploads/20240422-best-inexpensive-belgian-waffle-machine-.png

800

1200

Mary Hunt

https://www.everydaycheapskate.com/wp-content/uploads/EC-Logo-by-Mary-Hunt-Tagline-Trimmed.png

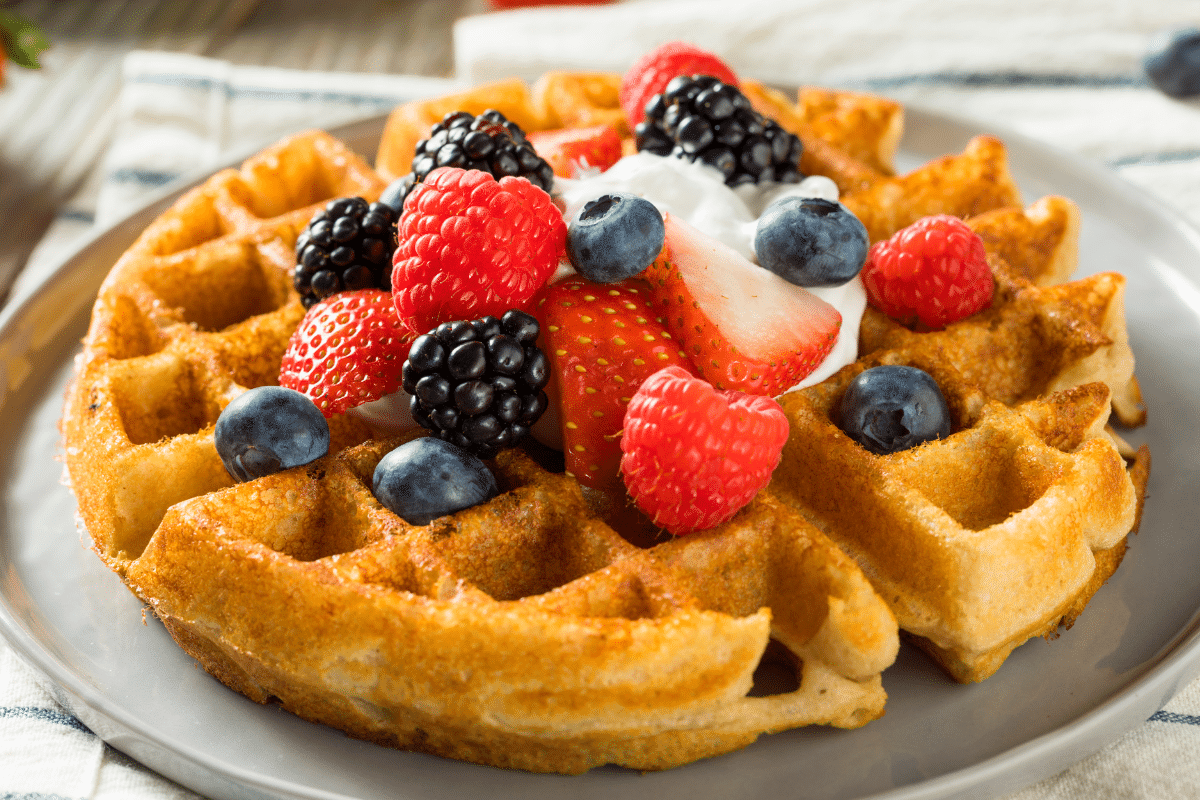

Mary Hunt2024-04-22 00:11:292024-04-21 17:35:41Best Inexpensive Belgian Waffle Machines

https://www.everydaycheapskate.com/wp-content/uploads/20240422-best-inexpensive-belgian-waffle-machine-.png

800

1200

Mary Hunt

https://www.everydaycheapskate.com/wp-content/uploads/EC-Logo-by-Mary-Hunt-Tagline-Trimmed.png

Mary Hunt2024-04-22 00:11:292024-04-21 17:35:41Best Inexpensive Belgian Waffle Machines https://www.everydaycheapskate.com/wp-content/uploads/20240421-a-homemade-frittata-in-a-cast-iron-skillet.png

800

1200

Mary Hunt

https://www.everydaycheapskate.com/wp-content/uploads/EC-Logo-by-Mary-Hunt-Tagline-Trimmed.png

Mary Hunt2024-04-21 00:40:452024-04-09 12:56:11What’s Better and Cheaper Than Eating Out? A Fabulous Frittata!

https://www.everydaycheapskate.com/wp-content/uploads/20240421-a-homemade-frittata-in-a-cast-iron-skillet.png

800

1200

Mary Hunt

https://www.everydaycheapskate.com/wp-content/uploads/EC-Logo-by-Mary-Hunt-Tagline-Trimmed.png

Mary Hunt2024-04-21 00:40:452024-04-09 12:56:11What’s Better and Cheaper Than Eating Out? A Fabulous Frittata!