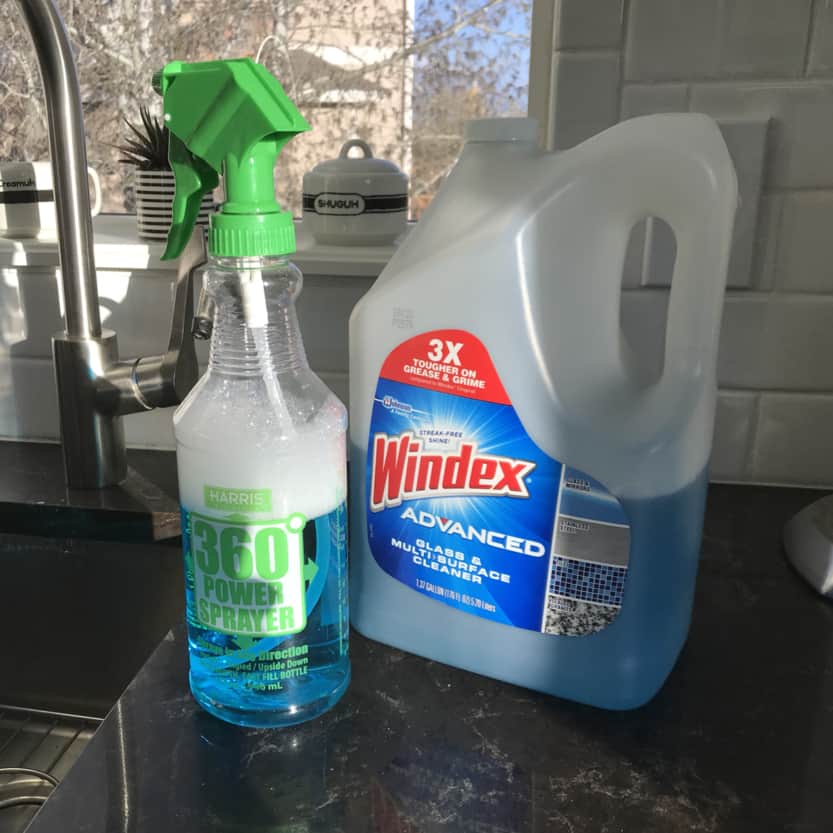

How to DIY Highly Effective Dusting Spray: Safe on Fine Wood Furniture

Make your own cheaper, better, faster DIY dusting spray with simple pantry ingredients to tackle dust on your fine wood furniture.

Welcome to Everyday Cheapskate!

Sign up HERE to get Mary’s Everyday Cheapskate™ daily newsletter. It’s short, usually sweet, and always a lot of fun (free eBook!)

https://www.everydaycheapskate.com/wp-content/uploads/20240418-mothers-day-brunch-overhead-view-scones-bread-fruit-coffee.png

800

1200

Mary Hunt

https://www.everydaycheapskate.com/wp-content/uploads/EC-Logo-by-Mary-Hunt-Tagline-Trimmed.png

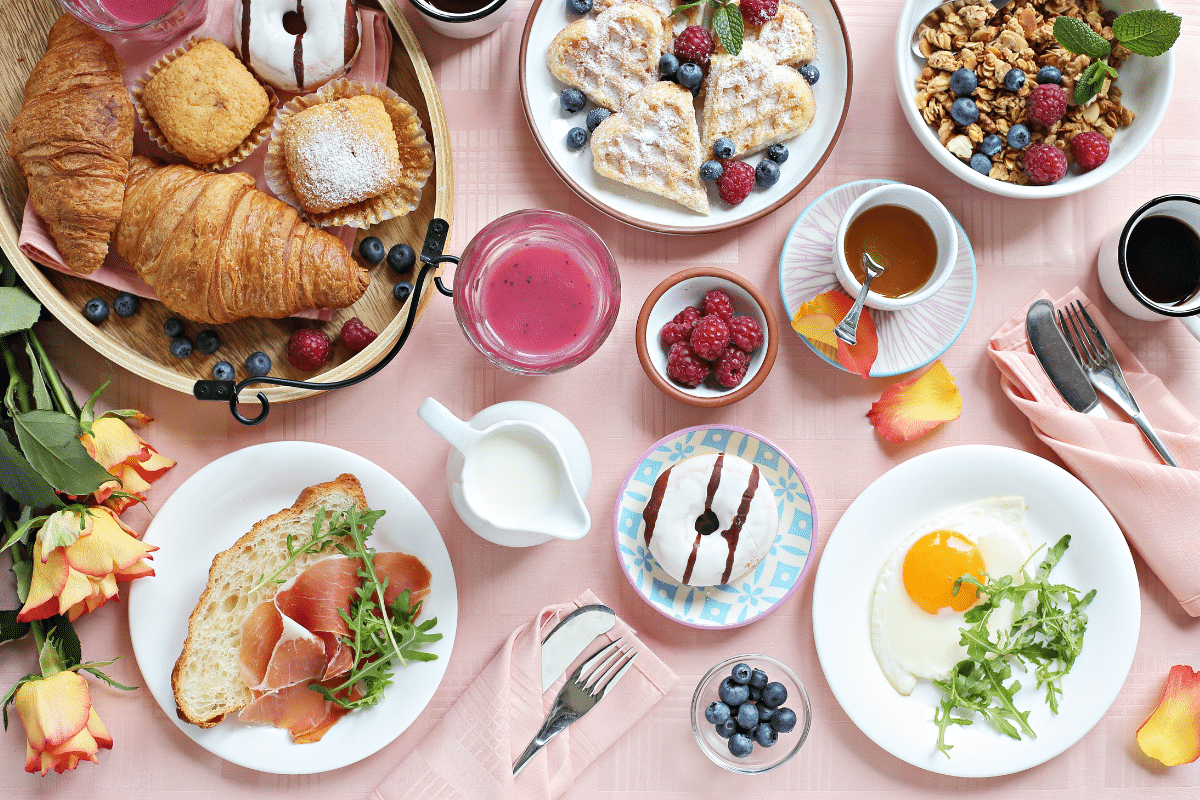

Mary Hunt2024-04-18 00:39:222024-04-18 13:57:47How to Plan, Prepare, and Host the Perfect Mother’s Day Brunch at Home

https://www.everydaycheapskate.com/wp-content/uploads/20240418-mothers-day-brunch-overhead-view-scones-bread-fruit-coffee.png

800

1200

Mary Hunt

https://www.everydaycheapskate.com/wp-content/uploads/EC-Logo-by-Mary-Hunt-Tagline-Trimmed.png

Mary Hunt2024-04-18 00:39:222024-04-18 13:57:47How to Plan, Prepare, and Host the Perfect Mother’s Day Brunch at Home https://www.everydaycheapskate.com/wp-content/uploads/20240417-Person-Feeling-discouraged-Over-Credit-Bills.png

800

1200

Mary Hunt

https://www.everydaycheapskate.com/wp-content/uploads/EC-Logo-by-Mary-Hunt-Tagline-Trimmed.png

Mary Hunt2024-04-17 00:03:212024-04-04 16:19:29How to Beat Discouragement to Get Through Tough Times Stronger Than Ever

https://www.everydaycheapskate.com/wp-content/uploads/20240417-Person-Feeling-discouraged-Over-Credit-Bills.png

800

1200

Mary Hunt

https://www.everydaycheapskate.com/wp-content/uploads/EC-Logo-by-Mary-Hunt-Tagline-Trimmed.png

Mary Hunt2024-04-17 00:03:212024-04-04 16:19:29How to Beat Discouragement to Get Through Tough Times Stronger Than Ever